Property Market Review – June 2020

THE ‘DEATH OF THE OFFICE’?

The coronavirus pandemic has left offices around the world standing empty, with many asking the question whether lockdown and the resulting shift to remote working, could spell the end of the office as we know it. However, according to new research from Knight Frank, this may be a ‘naïve‘ point of view.

Dr Lee Elliot, Partner and Global Head of Occupier Research, commented: “The office is central to the creation and maintenance of a corporate culture. It is essential to the innovation and creativity required to stay competitive. It is the place where essential (and often tacit) staff development and education occurs and where social connections transform into important professional collaborations. Businesses are immeasurably weaker without recourse to an identifiable collective hub.”

While new enquiries have fallen, the research shows that the amount of space under offer in London has not decreased markedly and few deals have been withdrawn as a result of the pandemic. Meanwhile, headline rents are set to hold firm despite a fall in transactional activity.

THE HOTEL SECTOR: WHERE ARE WE NOW?

Hotels and other hospitality businesses have been among the biggest casualties of the coronavirus lockdown as worldwide travel bans and hotel closures called an unprecedented halt to tourism. As the UK government begins its gradual easing of lockdown, what does the future hold for the beleaguered hotel sector?

The government’s emergency financial measures have been key to the sector’s survival during lockdown, providing access to business support loans, grant funding, 12-month business rates holiday and the Coronavirus Job Retention Scheme.

Many hotel operators are now hoping to reopen in July to salvage what they can of the summer high season; a UK staycation boom is much hoped for as people make up for previously cancelled holidays. While nothing is sure at this stage, most tourism industry experts agree that it is likely to be a slow recovery, especially for those that have historically relied on demand from overseas tourists or business travellers.

SCOTLAND’S COMMERCIAL PROPERTY MARKET POST LOCKDOWN

Investors are increasingly likely to seek off-market deals in the coming months, as experts predict that the COVID-19 crisis will have a “significant impact” on the Scottish commercial property market. Despite the initial shock of the pandemic, however, the market remains in a much better position than it was during the global financial crisis, concludes Knight Frank.

In fact, off-market deals were already becoming the norm in 2019, with £457m worth of offices in Edinburgh – or 87% of the total transactional value – agreed through off-market deals or a targeted approach last year.

Euan Kelly, Capital Markets Partner at Knight Frank in Edinburgh, offered a positive message for the future: “There is no doubt that COVID-19 will have a significant impact on the commercial property market this year. However, while the initial shock of the outbreak took many people by surprise, there are signs of the market beginning to thaw.”

COMMERCIAL PROPERTY CURRENTLY FOR SALE IN THE UK

![]()

- Regions with the highest number commercial properties for sale currently are the South West and North West of England

- Northern Ireland currently has the lowest number of commercial properties for sale (34 properties)

- There are currently 1,231 commercial properties for sale in London, the average asking price is £1,117,319

Source: Zoopla, data extracted 22 June 2020

| REGION | NO. PROPERTIES | AVG. ASKING PRICE |

|---|---|---|

| LONDON | 1,231 | £1,117,319 |

| SOUTH EAST ENGLAND | 1,294 | £651,432 |

| EAST MIDLANDS | 970 | £884,474 |

| EAST OF ENGLAND | 811 | £489,241 |

| NORTH EAST ENGLAND | 965 | £297,610 |

| NORTH WEST ENGLAND | 1,807 | £406,364 |

| SOUTH WEST ENGLAND | 1,805 | £588,608 |

| WEST MIDLANDS | 1,275 | £449,269 |

| YORKSHIRE AND THE HUMBER | 1,441 | £345,522 |

| ISLE OF MAN | 52 | £479,025 |

| SCOTLAND | 1,547 | £253,689 |

| WALES | 862 | £387,207 |

| NORTHERN IRELAND | 34 | £461,717 |

COMMERCIAL PROPERTY OUTLOOK

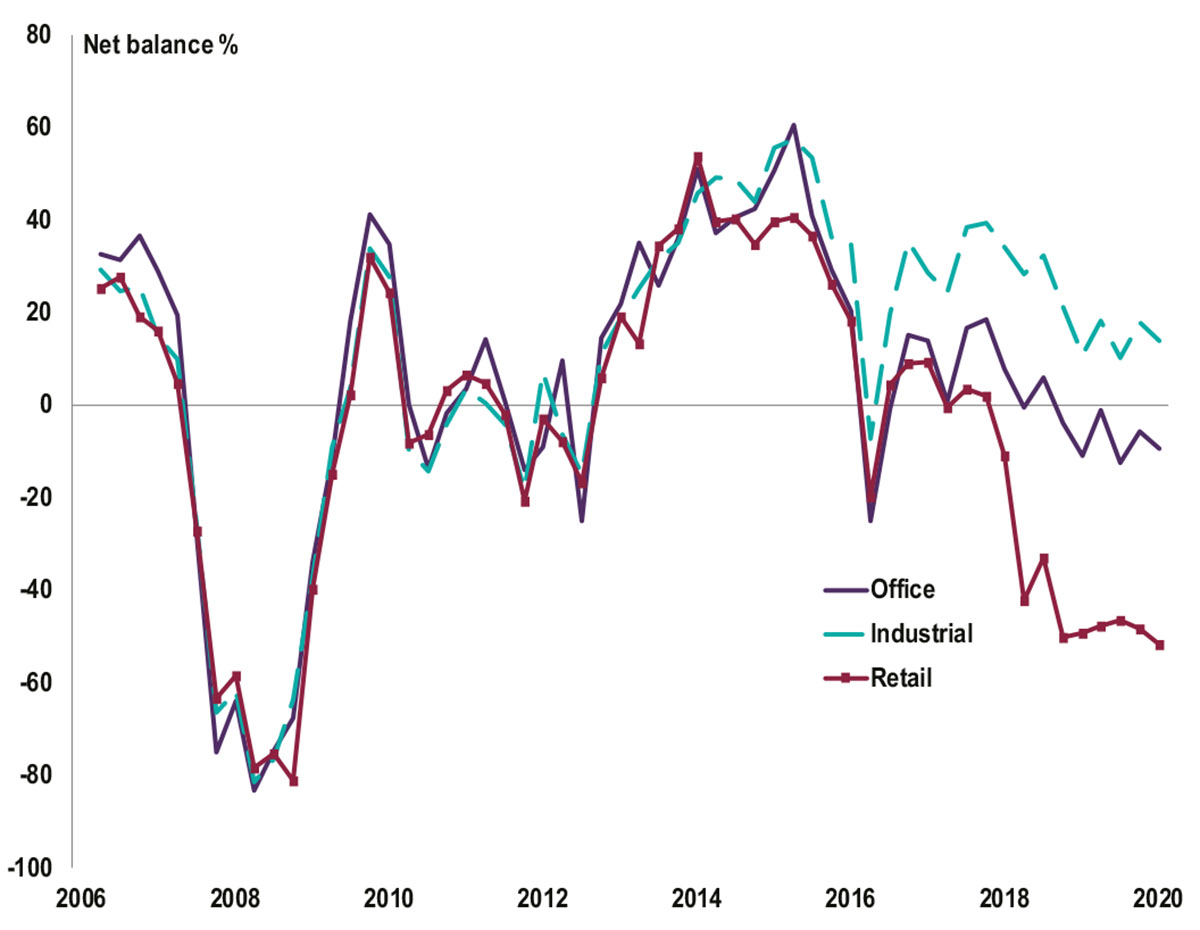

INVESTMENT ENQUIRIES – BROKEN DOWN BY SECTOR

</

</

- Enquiries continued to slip in Q1 2020

- Retail sector negativity remained

- Investor demand for office space also fell

- Overseas investment demand declined in each area of the market over the quarter

Source: RICS, UK Commercial Property Market Survey, Q1 2020

(This is the latest set of data. Next release is 30 June 2020)

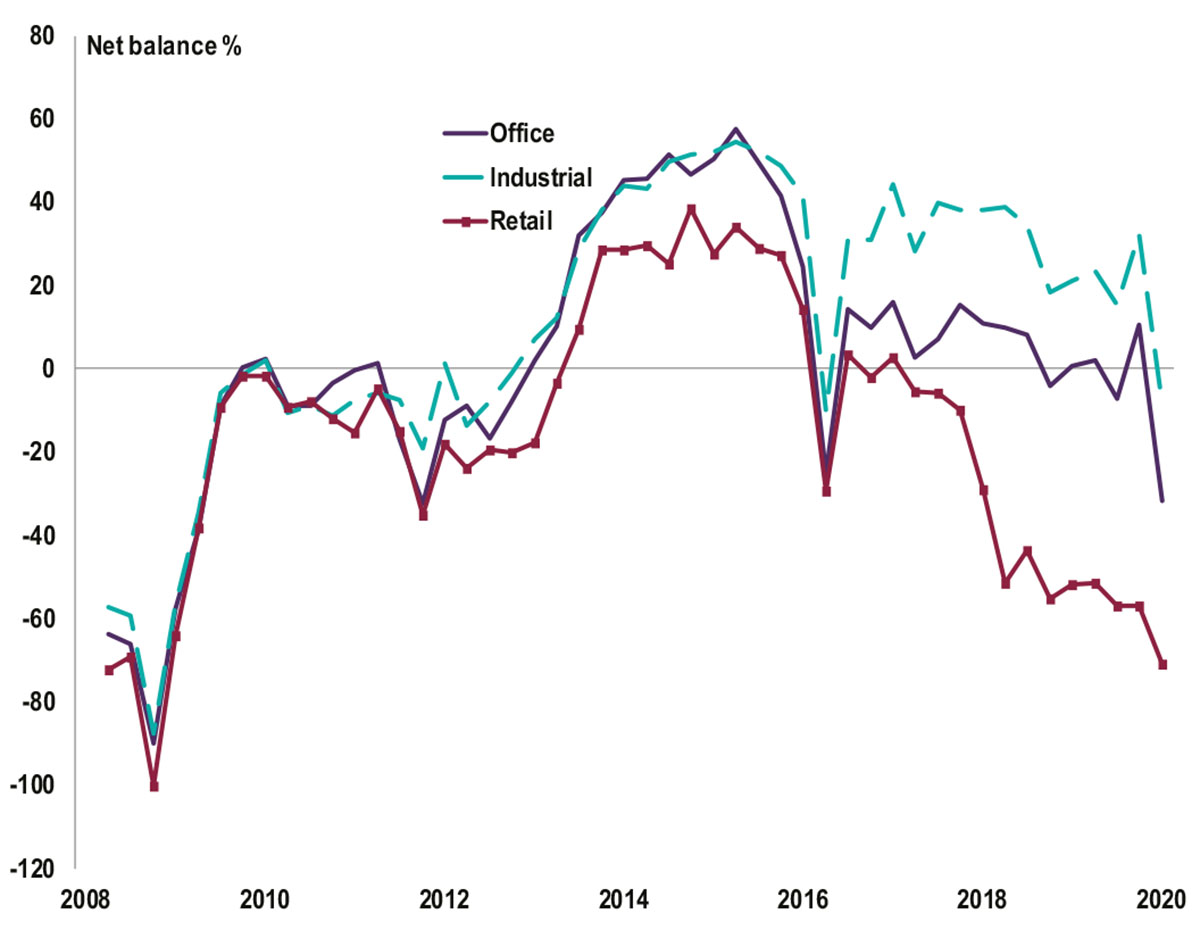

CAPITAL VALUE EXPECTATIONS – BROKEN DOWN BY SECTOR

- Capital value expectations for commercial property in Q4 fell from a net balance of -3% in Q1 to -35%

- Expectations are negative across all sectors, with the net balance standing at -32% for offices, -8% for industrials, -71% for retail values

- Looking forward 12 months, prime industrial values are expected to post modest capital growth

All details are correct at the time of writing (22 June 2020)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.